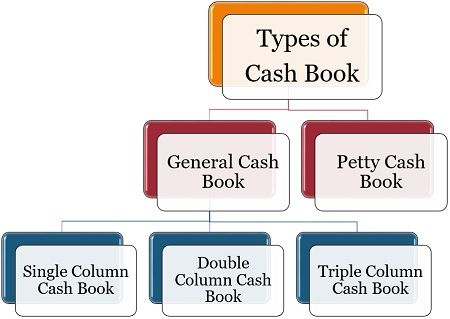

Explain the Different Types of Cash Book

It is further subdivided into three different categories. Format of Cash Book.

Cash Book By Waqar Ahmad Lecturer Management Science Department Rana University Kabul Afghanistan Www Facebook Com Waqar Ahmad25 Ppt Download

These accounts relate to companies and institutions such as Kapoor Pvt Ltd Ac Bookers Club Ac etc.

. All Cash receipts are recorded on the debit side and all the cash payments are recorded on the credit side of the cash book. Petty cash book can be expressed as a formal summarization of the petty cash expenditures which refers to the regular day-to-day expenses of a business which are not related to the companys direct. Triple column cash book.

A single column or simple cash book is that type of cash book which is used to note down only the cash transactions. 2 types of Cash Book are 1 general cash book and 2 petty cash book. All the payment made to creditors expenses incurred in cash and all other payments done appear on the credit side of cash book and the Auditor is required to vouch cash payments because chances of cash misappropriation are very high.

Followings are different types of cheques. Any changes on the face of the cheque will make it invalid. While the triple column cash book consists of cash bank and discount column.

Its similar to a single column cash book except it has two amount columns on both the debit and credit card. Thus companies and institutions are the entities that exist in the eyes of law. There are three common types of cash books.

It contains a debit side and a credit side. It contains three columns. Simple cash book contains only one amount column on each side debit and credit for recording cash.

Following points need to be considered for different types of cash payment. Double column cash books. A doubletwo column cash book to record cash as well as bank transactions.

One for discount second for cash and the third for the bank. It is the book of original entries because first of all we record the all-cash transaction in this book and then posted these transactions into the various ledger accounts. This column ensures the chronological record of each business.

Here one is compulsorily cash column and the. In most cases the petty cash book is an actual ledger book rather than a computer record. This is the simplest form of Cash Book and is used in businesses where payments are made and received mostly in cash and where usually no cash discount is received or given.

There are 3 types of cash books that are maintained by an organization. Single Column Cash Book. Double Column Cash Book- Cash Book with Bank Column.

Cash Book contains cash transactions passing into and out of business. Ad Browse discover thousands of brands. Double Column Cash Book.

Top 3 Types of Cash Books With Specimen Simple Cash Book. A cheque remains valid up to three months from the date written on it. The entry and posting of cash transactions are made by hand.

Petty cash book is an accounting book used to record the petty cash expenditures ie expenditures of small amounts that a company occurs in its day-to-day operations. Read customer reviews find best sellers. The date column of the cash book is used to record the year month and actual date of each cash transaction.

Sales journal is used for recording the credit sale of merchandise only. The petty cash book is a recordation of petty cash expenditures sorted by date. Whenever a business establishment or taxpayer applies for certificate of registration COR with the BIR it also required to register the book of accounts.

Usually the firms use triple column cash book. A single column cash book is like a ledger account. A single column cash book to record only cash transactions.

The said record is referred to as book of accounts. Single Column Cash Book. A double column cash book consists of cash and bank column.

This book keeps all cash payment and cash receipts. Here are the three type of Cash Books shown below. These accounts relate to natural persons such as Veers Ac Ayans Ac Karens Ac etc.

These are given below. The purpose of five columns used on both sides of a single column cash book is briefly explained below. The specimenformat of a single column cash book is given below.

In Cash book we will record the all-cash transaction of the business. Read this article to learn about the following types of cash book and its preparation ie 1 Simple Cash Book 2 Two-Column Cash Book and 3 Three-Column Cash Book. Thus the book is part of a manual record-keeping system.

4 Uncrossed or open cheque. Cash sale of merchandise is recorded in the cash receipt journal. Free easy returns on millions of items.

A petty cash book to record small day to day. The types of cash books are-Single column cash books. Simple cash book with single amount column on either side is.

The general cash book is subdivided into the single column double column and treble column cash book. Some organizations also maintain a petty cash book which records the petty or small cash expenses of the firm. Free shipping on qualified orders.

Single column double column and triple column. A single column cash book consists of only cash column. A double column cash book records two types of transactions under two separate columns.

A triplethree column cash book to record cash bank and purchase discount and sales discount. The petty cash book has declined in importance as companies are gradually eliminating all use of petty cash in favor of using. Also the books of account should also be registered annually on or before January 31 of each year.

How a Cash Book Works.

What Is Cash Book Accounting Quora

Differences Between Single Column Cash Book And Double Column Cash Book Qs Study

Cash Book Definition Types Example Format

What Is A Cash Book Definition Features Advantages Types Format Examples The Investors Book

Comments

Post a Comment